Imagine waking up one morning to find that the money in your bank account doesn’t buy what it did yesterday. Groceries cost more. Rent just went up. A vacation? Out of reach. For many, this isn’t just a hypothetical—it’s already reality. From Buenos Aires to Beirut, and even in parts of the United States, the value of local currencies has been quietly eroding. The culprit? A combination of mounting government debt and the unchecked expansion of the money supply.

This erosion of purchasing power isn’t always visible right away. But over time, it sneaks up. A cup of coffee that used to cost $2.50 might now cost $4. Gas prices jump, not because of supply chain issues alone, but because each dollar simply doesn’t stretch as far as it used to.

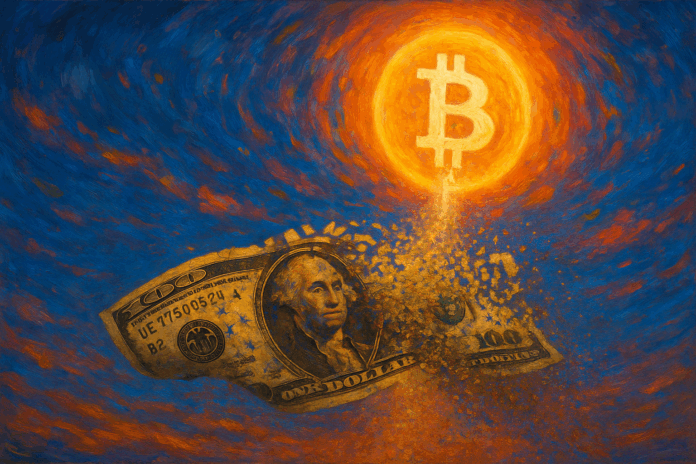

The Problem With Fiat

Fiat money—government-issued currency that isn’t backed by a physical commodity—relies on trust. Trust that the government will manage its economy responsibly. Trust that central banks won’t print too much money. And trust that inflation will remain under control. But what happens when that trust begins to erode?

In the U.S., the national debt has now crossed $37 trillion, with no signs of slowing. To meet obligations, the government increasingly borrows more—and the Federal Reserve often prints money to buy that debt. This creates a feedback loop where more dollars flood the system, decreasing the value of each one.

This isn’t just a theory. Historically, every fiat currency has eventually failed. Whether it was the German mark during the Weimar Republic or the Zimbabwean dollar in the 2000s, overprinting leads to hyperinflation, and hyperinflation destroys savings, contracts, and stability.

While the U.S. dollar still holds global reserve status, cracks are appearing. Several countries are seeking alternatives to the dollar for trade settlements, and central banks worldwide are quietly increasing their gold reserves.

The Case for Bitcoin

In this uncertain climate, many are turning to Bitcoin. Unlike fiat currencies, Bitcoin has a fixed supply: only 21 million will ever exist. No government or central authority can print more. This scarcity is what gives it its appeal.

Critics often argue that Bitcoin is too volatile. And yes, it is—compared to stable periods in traditional markets. But what Bitcoin offers is long-term monetary predictability. Its issuance schedule is transparent, coded, and enforced by a decentralized network of users and miners across the globe.

Bitcoin is also borderless and censorship-resistant. You don’t need a bank account or government ID to own it. In regions where currencies are collapsing or access to the banking system is restricted, Bitcoin offers a lifeline.

More institutional players are recognizing its potential too. Large asset managers, public companies, and even nation-states are adding Bitcoin to their balance sheets. Why? Because they view it as a hedge—not just against inflation, but against the broader instability of traditional financial systems.

A New Monetary Paradigm?

To be clear, Bitcoin isn’t a cure-all. It won’t replace national currencies overnight. But it’s becoming increasingly clear that the current financial system is on an unsustainable path. Infinite money printing may solve short-term crises, but it builds long-term imbalances that can be difficult—or impossible—to unwind.

As people begin to question the value of the money in their pocket, alternatives like Bitcoin are gaining legitimacy. Whether it’s used as a store of value, a remittance tool, or even a protest against monetary mismanagement, Bitcoin is forcing a global conversation about what money should be.

The future of money may still be unwritten. But if the past decade is any indication, it likely won’t be printed.

This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decision.