-

Central banks continue to add bullion to reserves, and global macro conditions- inflation concerns, currency weakness, geopolitical instability are driving the gold rally.

-

In recent analyses of safe-haven flows post-crypto crash, gold remains the “primary refuge in crisis,” while Bitcoin acts more like a “higher-beta speculative asset.”

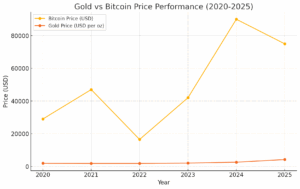

Gold Surges, Bitcoin Falters: 2025 in Numbers

2025 has delivered a powerful rebound for gold. Spot gold recently hit over $4,210 per ounce, posting a 58.6% year-to-date gain as of November 28, 2025.

By contrast, 2025 has been rough for Bitcoin (BTC). In multiple market stress events, Bitcoin dropped sharply, losing up to 15% from recent highs during episodes of geopolitical tension and policy-driven uncertainty.

This divergence is reshaping the safe-haven debate. Analysts argue 2025 may mark a turning point: gold now looks more like a refuge, while Bitcoin behaves more like a speculative risk asset.

Is Gold Outperforming Bitcoin?

Deep Liquidity, Established Infrastructure

Gold is a global asset with centuries of institutional adoption. Central banks, sovereign wealth funds and large funds hold gold in vaults, ETFs and bullion markets. That deep liquidity allows large volumes to flow without destabilizing price.

Contrast that with Bitcoin: while BTC enjoys high trading volume on exchanges, the broader infrastructure for global reserves, sovereign holdings, and large-scale settlement remains limited. Without that structure, Bitcoin struggles as a trusted asset in times of stress.

Safe-Haven Behavior Under Stress

Throughout history, gold has often been the asset that investors turn to when uncertainty rises. Count it during inflation, currency volatility or geopolitical turmoil. A recent 2025 cross-asset analysis reaffirmed that gold did exactly that: it rose when equities and risk assets fell. Meanwhile, Bitcoin’s performance was erratic. At its October crash, as stocks and risk assets tanked, Bitcoin dropped sharply while gold rallied.

That contrast reinforces gold’s role as a crisis hedge. Bitcoin remains highly volatile. According to academic research, Bitcoin’s standard deviation and tail-risk metrics are high — reflecting sharp drawdowns and unpredictable swings.

Institutional Demand and Reserve Rebalancing

2025 has seen record inflows into gold-backed ETFs and renewed central bank purchases. In India alone, gold ETFs registered inflows of about INR 276 billion (≈ US$ 3.1 billion) during the first 10 months of 2025 — the highest annual inflow on record.

Globally, many sovereign reserve managers seem to be re-allocating toward gold as uncertainty about fiat currencies, debt levels and geopolitical risk rises. This institutional demand adds structural support to gold’s upward trajectory.

What This Means for Investors: Strategic Takeaways

Gold remains the reliable safe haven

For capital preservation, inflation hedging, and crisis protection, gold is delivering in 2025. High liquidity, global acceptance, and institutional backing make it a top pick for conservative portfolios.

Bitcoin remains a high-risk, high-reward satellite

Bitcoin still offers upside potential. But its volatility, susceptibility to macro shocks, and lack of institutional reserve infrastructure make it unsuitable as a core safe-haven asset, especially when stability matters.

Diversification over substitution

Rather than substituting gold with Bitcoin, the smarter play is combining them. Gold can anchor a portfolio; Bitcoin can function as a growth-oriented satellite capturing upside when markets recover, but not relied on during downturns.

Monitor macro trends actively

Given gold’s sensitivity to interest rates, inflation, currency moves and geopolitical risk, investors should stay alert. If global uncertainty remains high in 2026, gold may continue to outperform. If risk sentiment returns strongly, Bitcoin may recover some of its luster.

Looking Ahead: Why Gold’s 2025 Revival May Matter for 2026 and Beyond

The 2025 divergence between gold and Bitcoin suggests more than a temporary rotation. It reflects structural differences in asset class behavior.

Gold is reasserting itself not just as a commodity or investment but as a cornerstone of global financial stability. With central banks and institutional investors reaffirming commitments to bullion, gold could remain central to global portfolios.

Bitcoin retains value as a high-beta speculative instrument. But for now, it lacks the depth, trust, and systemic integration needed to replace gold. For many investors and institutions, Bitcoin remains an optional allocation — not a core reserve.

Demand for gold is not only from retail or sentiment but institutional demand is rising sharply. In Q1 2025, total investment demand increased to 552 metric tons, a more than 170% year-on-year jump. In short: 2025 is shaping up as the year when investors globally reminded themselves why gold was and still is “old money’s” safe haven.

Frequently Asked Questions

Is gold a better investment than Bitcoin in 2025?

Yes. Gold has delivered positive returns and acted as a safe haven during market stress. Bitcoin has not.

Why did Bitcoin fall while gold rose in 2025?

Bitcoin is still a risk-on asset. When liquidity falls or markets panic, investors sell BTC first. Gold benefits instead.

Will Bitcoin replace gold?

Not yet. Bitcoin lacks regulatory clarity, institutional trust, reserve utility, and stability.

What is the best portfolio strategy?

Use gold as core protection and Bitcoin as a small satellite allocation for growth.